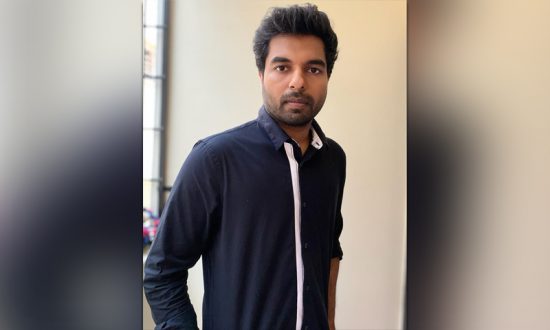

Vishwajit Pureti is the Co-founder & Marketing (CEO) of Pencilton since 2019 and the team set up is based at Hyderabad. His career has seen a healthy mix of entrepreneurship, business development, and product-specific sales & marketing. A BE(Hons) in Mechanical Engineer, Vishwajit completed his PGDM from IIM Kozhikode in 2017. As an undergrad, along with other co-founders Pallavi and Viraj, he ran various enterprises, and as a result is very well-versed in marketing especially to the 10-19 years age segment. Prior to co-founding Pencilton, he rejected the PPO to work on Kubero, where he co-founded and built the GTM and led partnerships & marketing strategy. He managed to partner with 38 schools and state government during the pilot run of the project. It is now successfully adopted by many leading institutions in India.

Digitization in India is propelling higher growth in a wide variety of Indian industries, even some traditional ones. This fast growth gains accelerated momentum from fast adoption of these technologies by Indian consumers. Reports peg Indians as the 2nd fastest digital adopters among 17 major digital nations. The pandemic has acted as an added catalyst in the above mix in making adoptions still faster.

The most significant impact of digitisation has been the automation in the delivery of financial products and services by the fintech industry. In fact, India has one of the highest fintech adoption rates in the world at 87% vis a vis the global average of 64%. With a sizeable population of tech savvy Indian youth population and other conducive factors, Fintech is gaining immense popularity with the next-gen of the country.

The growing smartphone adoption among teenagers in India

Various studies have found that rising smartphone penetration in India, especially among the youth is driven not by young adults but by teens. India has 451 million monthly active internet users, out of which 66 million are between the age of 5 to 11 years. In addition to this, the highest smartphone penetration rate in India was estimated at 37% and was found to be in the 16–24-year age group. This is primarily because smartphones are no longer a luxury; the pandemic has turned it into an essential tool in our daily lives. Smartphone usage by children, earlier restricted to gaming, is now their closest pal and facilitator. With the right parental controls, this can be a huge advantage for children as they can be taught basics of money and how to manage it at an early age for a strong and secure financial future.

The increasing pocket money allowance for teens

Why is learning to manage money at an early age important?

Today’s children are receiving higher allowances than ever before. An ASSOCHAM survey found that children in the age group of 10-17 years receive on an average, Rs. 1500 as pocket money now as compared to a mere Rs. 125 in the year 1998. Among 16- to 21-year-olds, this amount has gone up to Rs. 6000. Children are spending money on buying smartphones, online gaming, eating out, cosmetics and apparel which makes it crucial that parents make them financially literate and independent at the earliest.

Evolving fintech landscape that makes payments a breeze

Ever since Digital India started in 2015, there has been a strong policy push towards making India a cashless society, spurring the growth of payment solutions like UPI. It allows instant payments without the need to input data, making it the most used digital payment solution in India. Contactless payments like Near Field Communication (NFC) further provide safe and convenient alternative payment methods. Interoperability of QR codes is expected to further promote digital transactions. It means you can now use just one QR code to make payments across merchants and without the hassle of downloading multiple payment apps for digital transactions. The recent RBI mandate providing for interoperability of balances in digital wallets like PayTM, PhonePe and others (called PPI or prepaid payment instruments) through the UPI network is likely to make acceptance of digital payments grow higher. These steps to enhance safety and the sheer ease of transacting have made acceptance of fintech and digital payments among teens or the Instagram generation truly a breeze.

User friendly apps of various banking services which were previously tedious and lengthy processes

Compared to the lengthy paperwork and tedious processes of yore for making investments, fintech has made investing as easy as the click of a button. Fintech apps like Zerodha are a huge hit among the young professionals because they make investing in stock market easy. Insuretech apps enable purchase of insurance on their app without the need for long drawn documentation and approvals. Also, there are a number of digital wallets like PhonePe and PayTM that enable purchase of insurance, mutual funds and gold at the click of a button. Pocket money management apps such as Pencilton, Fampay and Junio which teach children personal finance using their e-pocket money help teens get a debit card even without a bank account.

Tech-powered KYC processes facilitate easy on-boarding and seamless flow for a tech-friendly generation

Earlier, KYC processes in Indian banks entailed numerous visits to the bank with physical copies of original identification documents for verification. Now OTP based KYC and Video KYC, allowed by RBI, simplify and make it universally accessible for all. This has led to a seamless user experience for teens and adults alike. This ease of doing KYC is crucial for a smooth experience that lets the next generation sign up and try out and engage with various new apps from the convenience of their smartphone.

Easier plug & play API stack (for various fintech tools such as cards, UPI, credit, etc) that evolved just in the last 2 years

The last two years have seen the emergence of not just UPI but various fintech tools based on plug and play API stack. Open APIs have truly brought about innovative solutions by fintech companies that have made digital payments faster and easier. Banking as a Service (BaaS) has been a crucial contributor too. Fintech players act as conduits in helping non-bank businesses partner with fully licensed banks to offer wallets, debit cards, loans and payment services at low costs and even quicker turnaround times. These innovations bring new age tools and features within easy reach of the next generation at an accelerated pace.

Financial literacy has been a critical gap in the younger generations’ education. Now they have golden opportunities – combine the age-old learnings of their parents with the best experiential activities fintech tools offer through easy accessibility via their smartphones. From a high-cash economy to one of the world leaders in fintech adoption and innovations, we are uniquely poised to help our coming generations build their lives with greater financial control for a better future.